Mortgage calculator for additional principal payments

Of course paying additional principal does in fact save money since youd effectively shorten the loan term and stop making payments sooner than if you were to make the minimum payment. Use our simple mortgage calculator to quickly estimate monthly payments for your new home.

Free Interest Only Loan Calculator For Excel

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Using our mortgage rate calculator with PMI taxes and insurance.

Check out the webs best free mortgage calculator to save money on your home loan today. Cross-reference these values with your mortgage calculator. This is because the principal or outstanding balance is larger.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. But before you make additional mortgage.

Building a Safety Buffer by Making Extra Payments. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. By changing any value in the following form.

Thus most homeowners should plan to adjust the budget as the loan matures. 30-Year Fixed Mortgage Principal Loan Amount. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

M Monthly Payment. Extra payments are additional payments in addition to the scheduled mortgage payments. Additional mortgage payments have the biggest impact during the first years of the loan.

Your principal should match up exactly with the original loan amount. A good mortgage calculator factors in not only principal and interest but also additional home costs like taxes home insurance private mortgage insurance and homeowners association dues. Any extra payments will decrease the loan balance thereby decreasing interest and allowing the borrower to pay.

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost.

The Math Behind Our Mortgage Calculator. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. Using the 250000 example above enter 50.

Your monthly mortgage payment has two parts. The earlier you. If they match youve done the formulas correctly.

One or more of these companies will contact you with additional information regarding your request. Your monthly mortgage payment may also include property taxes and insurance. Additional payments to the principal just help to shorten the length of the loan since your payment is fixed.

Your principal is the amount that you borrow from a lender. If it does your lender holds a percentage of your monthly payment in an escrow account. Credit card debts car payments etc.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Why Early Extra Payments Matter. Enter amount Please enter an amount for additional payments that is greater than 000 and less than the mortgage amount.

Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. In the example above after one year of additional payments the principal amount would increase to 13700. Our calculator includes amoritization tables bi-weekly savings.

R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. 100 per month. While analyzing the various methods of making extra mortgage payments consumers should consider their individual financial status.

How to estimate mortgage payments. The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments. P Principal Amount initial loan balance i Interest Rate.

Whatever extra you pay today is extinguished debt not accruing any further. Mortgage loan basics Basic concepts and legal regulation. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

However that only happens after a certain. This is the purchase price minus your down payment. Mortgage calculator - calculate payments see amortization and compare loans.

Use this free calculator to figure out what your remaining principal balance home equity will be after paying on your loan for a specific number of months or years. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment.

It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan. The calculator allows you to enter a monthly annual bi-weekly or one-time amount for additional principal prepaymentTo do so click Prepayment options Lets say for example you want to pay an extra 50 a month. You may think 50 or 100 a month is a small sum but no amount is too small.

The interest is the cost of borrowing that money. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

This free mortgage tool includes principal and interest plus estimated taxes insurance PMI and current mortgage rates. Your payments should match the total cost of the loan from the mortgage calculator. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

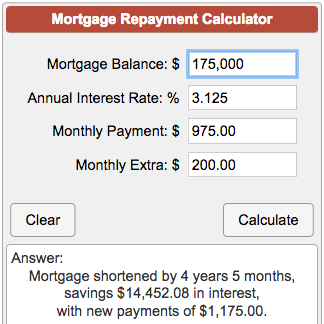

Enter your original mortgage information along with your extra payments using the calculator below to see how much interest you will save and how much sooner your loan will be paid off in full. If you want to add extra payments to your loan to pay it off quicker please use this calculator to see how quickly you will pay off your loan by making additional payments. Borrowers can make these payments on a one-time basis or.

The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. Principal and Interest of a Mortgage. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

At the bottom of the table sum the payments interest and principal. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. A very big portion of the earlier payments will go towards paying down interest rather than the principal.

Mortgage Payoff Calculator With Line Of Credit

Mortgage Calculator For Extra Payments On Sale 51 Off Www Wtashows Com

Mortgage Calculator How Much Monthly Payments Will Cost

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage With Extra Payments Calculator

Mortgage Calculator For Extra Payments On Sale 51 Off Www Wtashows Com

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator For Extra Payments Cheap Sale 58 Off Www Wtashows Com